How is the Student-Managed Investment Fund going and what is in store for the future? Find out here.

By Emily Jan

Last December, the Clarion published an article about a fund that business students could participate in to learn how to properly manage finances, marketing and more.

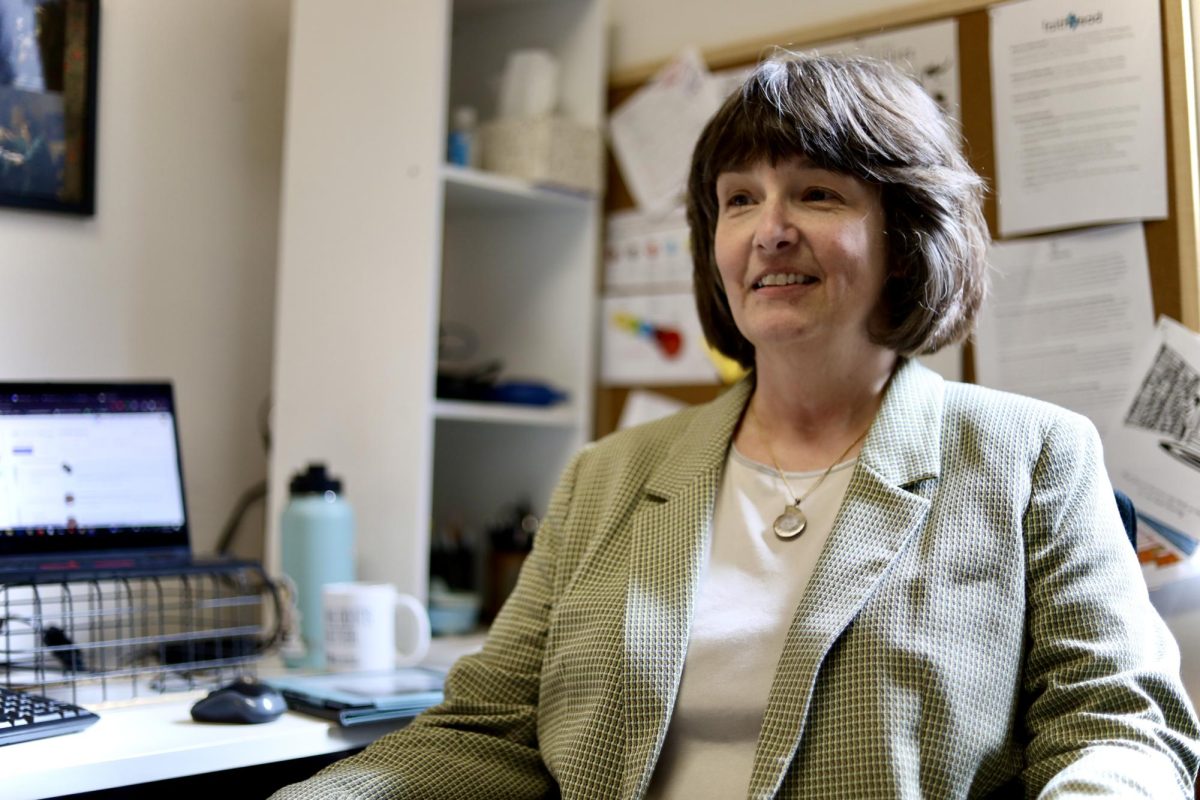

The Student-Managed Investment Fund is actually a company, a limited liability (LLC), according to fund academic advisor and business and economics professor Amanda Carter.

“I think it’s just a really great opportunity for students to learn not just about research and picking stocks, but about how a company and the investment management world works,” Carter stated.

SMIF is not a class, but an extracurricular activity with an application process to join. Basically, everything students learn in the classroom, they are able to apply in an experiential learning environment, which is SMIF.

The fund is currently comprised of mostly upperclassmen with a few sophomores, but they hope to grow in the future and add more clients. There are 19 students, four professors, and two alumni.

Students on the leadership team of SMIF include Tyler Meyer, Chief Investment Officer; Marnie Zilka, Head of Operations; and Jake Worthen and Justin Bonanno, portfolio managers.

The group broke this year into two parts: a soft launch and a full launch of the fund, according to Meyer.

For the full launch second semester, they are looking at making funds into securities and other companies into which they will invest. In addition, they are in the process of adding more individual clients.

Background and challenges

Thrivent Financial agreed last year to invest $1 million to kickstart SMIF, but other private donors invest as well. Students learn a multitude of skills in SMIF: how to research companies, investment management operations, and client relationship acquisition and retention.

The most challenging part about SMIF is time-management, because it is a large amount of work on top of students’ already incredibly busy lives, Carter said.

Students are doing a lot of work setting up different types of reports, working on client acquisition with individual investors, and researching companies for stock selection.

For Meyer, the biggest challenge is connecting with clients and having solid communication.

“Just like any organization, communication is really key,” Meyer said.

Meyer appreciates the real-world experience students receive and that they learn how to transition and use that as they enter the workplace.

Carter explained how the fund has some biblically-responsible investing principles, which means they avoid some companies they think might be displeasing to God, such as tobacco and alcohol companies.

“We are integrating faith into our processes,” Carter added.

The future

In the future, Meyer would like to see more students involved, more clients and the fund being incorporated into a class. He also explained that SMIF is matching the market right now, but as the full launch continues, they aim to beat the market.

Carter hopes the fund will get more individual investors in the future. She also strives to see students doing more research, picking stocks, communicating to clients well and meeting the regulatory and reporting requirements.

“I think success would be a good learning for the students and happy clients,” Carter said.

The Clarion also reported last year that eventually, the business department hopes to transform the extracurricular fund to a three-credit course, specifically focused on investment management.

![Nelson Hall Resident Director Kendall Engelke Davis looks over to see what Resident Assistant Chloe Smith paints. For her weekly 8 p.m. staff development meeting in Nelson Shack April 16, Engelke Davis held a watercolor event to relieve stress. “It’s a unique opportunity to get to really invest and be in [RAs’] lives,” Engelke Davis said, “which I consider such a privilege.”](https://thebuclarion.com/wp-content/uploads/2024/05/041624_KendallEngelkeDavis_Holland_05-1200x800.jpg)