A generous donation given to the Bethel business department launches the Royals Investment Fund.

By Jasmine Johnson

Bethel business students are gearing up for Bethel’s own version of “Shark Tank,” an MSNBC television series featuring budding entrepreneurs.

In “Shark Tank,” a panel of multi-millionaire investors allow hopeful entrepreneurs one chance to hook them on a business proposal through a series of negotiations. To conclude each episode, the selective school of sharks either strike a deal with the contestants or send them home.

Incorporating a realistic form of “Shark Tank,” Thrivent Financial recently agreed to invest $1 million to kickstart a student-managed investment fund (SMIF) at Bethel University.

Business professors first pitched the idea to students via email regarding an informational meeting. They were encouraged by the students’ interest.

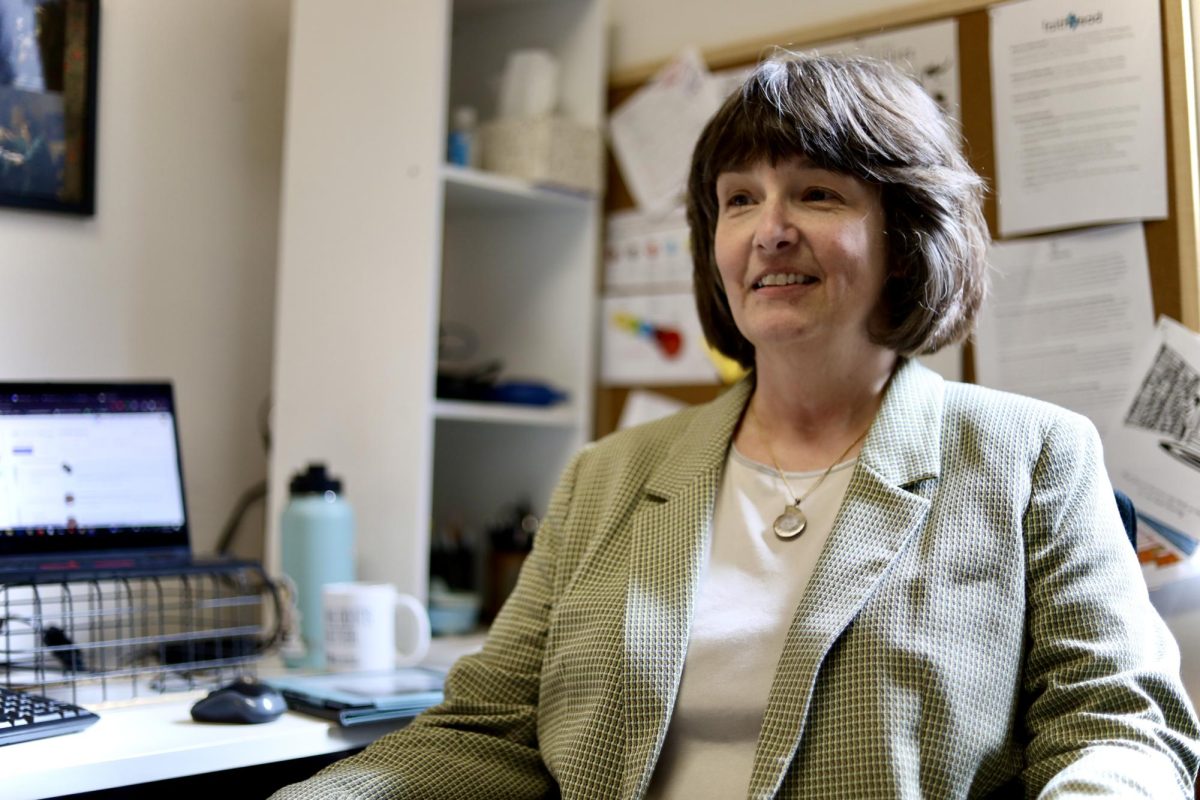

“A lot of students showed up, which we were really happy about,” said professor Amanda Carter, the fund academic advisor. “There were more students than we really had space for in the fund.”

Initially, the professors were looking for 10 to 12 students, but over 30 applied. To solve this problem, they split the tasks into industry-specific groups, allowing them to take 19 participants. Positions such as research analysts, relationship managers, operations and risk managers, and a marketing team were created to take on various tasks to help all aspects of the fund run smoothly.

Tyler Meyer was elected to the leadership role of the chief investment officer. In this position, Meyer oversees the smaller teams that make up the investment fund. Two other fund managers, Jake Worthen and Justin Bonanno, collaborate with Meyer to facilitate the fund.

“The fund is designed to allow business students an opportunity to learn about managing a fund as well as hands on experience with tasks that go along with their major,” Meyer said.

The fund is purely student led, but professors Amanda Carter, Dean Junkans, and Chuck Hannema offer their guidance and knowledge as members of the steering committee. In addition to the faculty, an advisory board composed of six industry professionals including some Bethel graduates, also assist the students.

“The advisory board helps teach the students and recommends ways they could run it,” said Marnie Zilka, the operations and risk manager. “They help us with decisions about the fund and guide us to ensure we do not make any mistakes.”

Although the first SMIF originated in the 1950s, the idea did not begin to spread until forty years later. Seeing this initiative benefit other universities in the area, Bethel caught on to the trend.

“I think Bethel realized the learning potential there,” Meyer said.

Although Thrivent is the primary donor for this project, a few individual donors are looking to invest in the fund as well. The individuals would contribute a much smaller portion than Thrivent and could earn a profit from their contributions if the students’ work succeeds.

“For Thrivent, it was a donation that they could have invested into a new lab,” Meyer said. “Instead, they wanted to give students the ability to learn from this fund.”

Rather than classroom simulations, interaction with the fund engages students in valuable, realistic scenarios. This pressure helps students develop caution and thoroughness.

It’s fine to learn concepts in a classroom, but applying it in a real-world example is a better way to learn.

“It’s real money, real clients and real-world experience,” Meyer said. “We learn how to meet with clients, present material and balance a lot of responsibility.”

In addition to the valuable experience, students become comfortable with the program FactSet. By gaining exposure to this tool, it prepares students to be successful in their future jobs.

“It’s fine to learn concepts in a classroom, but applying it in a real-world example is a better way to learn,” Carter said.

Eventually, the business department hopes to transform the extracurricular fund to a three-credit course, specifically focused on investment management.

Even though this is the first year of the Royals Investment Fund, the business department expects increasing success in the years to follow.

“I could absolutely see it growing into something broader and fully curricular as opposed to extracurricular,” Carter said, “It’s a lot of work to develop a course from scratch, but a lot of schools do it that way.”

Thrivent contributed a significant investment to Bethel’s SMIF. This initiative will prepare students for their professional lives beyond the college experience.

![Nelson Hall Resident Director Kendall Engelke Davis looks over to see what Resident Assistant Chloe Smith paints. For her weekly 8 p.m. staff development meeting in Nelson Shack April 16, Engelke Davis held a watercolor event to relieve stress. “It’s a unique opportunity to get to really invest and be in [RAs’] lives,” Engelke Davis said, “which I consider such a privilege.”](http://thebuclarion.com/wp-content/uploads/2024/05/041624_KendallEngelkeDavis_Holland_05-1200x800.jpg)